Debt is one of those things we hate, but can't seem to live without. We use debt to purchase our cars, homes, fund our studies, and in some cases, pay for food and clothing. These days people are using debt more and more to fund their lifestyles.

The dreaded D-word: Debt

Interest

Payment period

Minimum instalment due

Debt-to-income ratio

Debt-to-income Ratio

Therefore, it does not come as a surprise that "Households Debt in South Africa increased to 72.80 percent of gross income in 2019 from 71.90 percent in 2018." (Trading Economics). This means that almost three quarters of South African households' gross income goes towards making monthly debt payments.

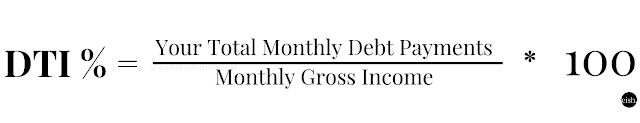

How does one calculate what percentage of their gross income goes towards making monthly debt payments? They calculate this by working out their debt-to-income ratio and multiplying it by 100.

Debt-to-income ratio formula

An individual's debt-to-income ratio (DTI %) is calculated as follows:

DTI % = (Your Total Monthly Debt Payments) / (Monthly Gross Income) * 100

It is generally understood that the lower, the better when it comes to one's debt-to-income ratio. This is because consumers with a low debt-to-income ratio are attractive and are perceived as less likely to fail at managing their monthly payments. The consumer in this instance is perceived to be a lower risk than a consumer with a higher debt-to-income ratio (all other things being equal). However, this is not the only factor lenders look at when an individual applies to them for a loan.

Based on the information given above, Lebo's debt-to-income ratio can be calculated as follows:

DTI % = (R13 500/R20 000) * 100

= 0.675 * 100

= 67.5%

This means that 67.5% of Lebo's monthly gross income goes towards paying his debts. That's just over two-thirds of his monthly gross income. Yikes!

*Please note that this is only an illustrative example, and as such does not necessarily reflect any individual's actual monthly debt payments and/or monthly gross income.

So, how does one work out whether or not their debt-to-income ratio is good?

- 0 to 20% is considered good

- 21 to 40% is evaluated as fair

- 41 to 60% is seen to be at risk

- 60%+ can be considered over extended

Based on the above, Lebo can be considered over extended (67.5% > 60%). This is because his debt-to-income ratio is within the 60%+ range.

Overextended

It can be said that Lebo is financially overextended and should consider ways to minimise his debt levels and increase his income in order to improve his debt-to-income ratio.

Closing

This blog post took a look at what to consider when taking on debt and the debt-to-income ratio. Next week, we'll take a further look at Lebo's debt. I hope you enjoyed reading this blog post and learned about debt, particularly the debt-to-income ratio, and the effect this can have on one's finances.

Take care,

Disclaimer:

This blog post is for informational purposes only and does not constitute financial advice.

The information presented herein is not a substitute for and should never be relied upon for professional financial advice.

Always talk to your financial advisor about the risks and benefits of any financial information shared. If you are looking for financial advice, kindly speak to somebody who is certified and registered with the Financial Sector Conduct Authority (FSCA).

eishstudentbudget™ and its owner(s) are not liable for any loss, harm, or damage you may incur as a result of you using the information presented here.

Always talk to your financial advisor about the risks and benefits of any financial information shared. If you are looking for financial advice, kindly speak to somebody who is certified and registered with the Financial Sector Conduct Authority (FSCA).

eishstudentbudget™ and its owner(s) are not liable for any loss, harm, or damage you may incur as a result of you using the information presented here.

Thank you for this insightful analysis which is simplified. I just wanted to check, when calculating the debt-to-income ratio, do I I close my monthly expenses as well? in your example you have a car repayments, rent, insurance, do i include all monthly expenses like groceries, levies, medical aid, entertainment etc or I only add up debt??

ReplyDeleteHi Bunjiwe,

DeleteI apologise for the late reply.

Thank you for the lovely feedback & for taking the time to read this blog post.

The monthly expenses that are included to arrive at your total monthly debt payments are those monthly expenses that you can't avoid paying or you can't change the amount you pay. For example, you can't avoid paying school fees or change the amount of school fees you pay. It's can't be done at your discretion. You'd have to meet with and discuss this with the school. So, things like your car repayments, rent, insurance, levies, medical aid, etc are definitely included in calculating your monthly debt payment.

Expenses that are not included in your total monthly debt payment are expenses like entertainment and groceries. This is because you can avoid paying them (don't stop paying for groceries, we don't want you to starve!) and/or you can change the amount you pay for them. It's done so at your discretion. That's why these expenses that you do not include (groceries, entertainment, etc) are called discretionary expenses. You can spend money on them at your discretion (your choice).

You can read the fourth paragraph on this article by TransUnion that also explains it: https://www.transunion.co.za/archives-article/whats-the-state-of-your-credit#:~:text=To%20work%20out%20your%20debt-to-income%20ratio%2C%20add,debt-to-income%20ratio.

I hope this answers your question. Let me know if you need further clarification.